Ability to generate Correction Reports

The Altova CbC Reporting Solution makes it easy to generate a valid CbC XML filing report using a user-friendly web interface.

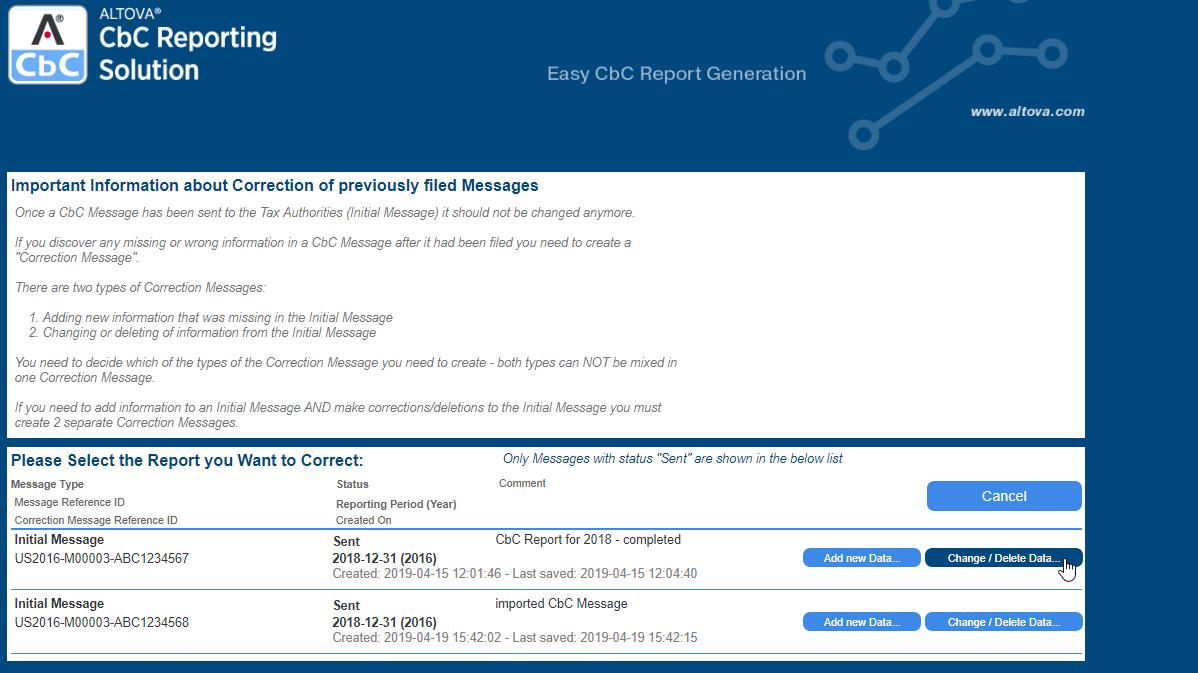

However, sometimes after a CbC report has been submitted to financial authorities, the submitting organization has a need to correct some information in or add some additional data to the report. When this is the case, a correction report must be created to update the filing.

Because a correction report must refer to internal IDs of the original report, it can be difficult to create manually.

Starting with Version 2.0, the Altova CbC Reporting solution makes it easy to generate a valid correction report automatically to update numbers or add new content.

In the correction report creation page, you'll find a list of existing reports. When you click the button to add new data or change/delete existing data, a new correction report is opened that contains all the necessary references to the original report.

Once you have made the necessary updates and saved the correction report, you'll find it listed with other existing reports. Simply click Create XML to generate the valid CbC correction report for submission.