修正レポートの作成機能

Altova CbC Reporting Solutionは、使いやすいWebインターフェースを通じて、有効なCbC(カントリー・バイ・カントリー)XML報告書を簡単に作成できます。

しかし、企業が金融当局にCbC(多国籍企業における国別報告)報告書を提出した後、提出した組織が報告書内の情報を修正したり、追加のデータを追加する必要が生じることがあります。そのような場合、報告書の内容を更新するために、修正報告書を作成する必要があります。

修正報告書は、元の報告書の内部IDを参照する必要があるため、手作業で作成するのは困難な場合があります。

Altova CbC Reportingソリューションは、バージョン2.0から、数値の更新や新しいコンテンツの追加を行うための、有効な修正レポートを自動的に生成する機能を備えており、その操作が非常に簡単です。

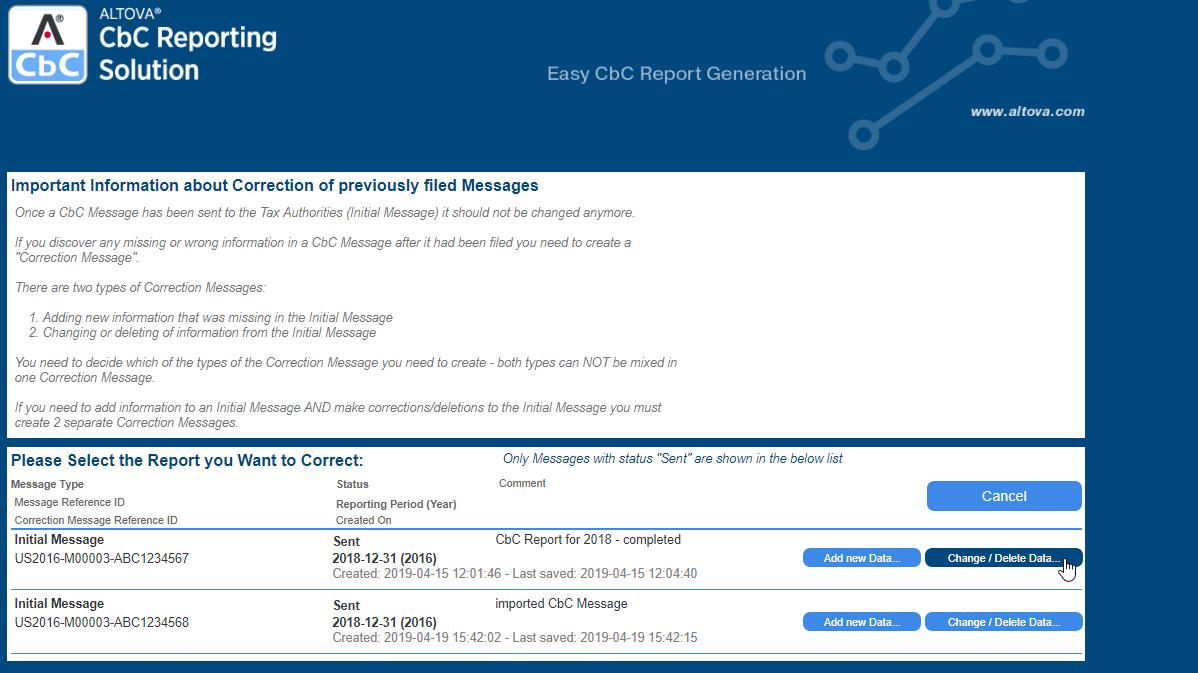

修正レポート作成ページでは、既存のレポートの一覧が表示されます。新しいデータを追加したり、既存のデータを変更・削除したりするボタンをクリックすると、元のレポートに必要な情報がすべて含まれた新しい修正レポートが開きます。

必要な更新を完了し、修正レポートを保存すると、そのレポートが他の既存のレポートと共に一覧に表示されます。修正レポートを送信するために必要な、有効なCbC修正レポートを作成するには、「XMLを作成」をクリックしてください。