US-GAAP XBRL Reporting: Requirements, Challenges, and Solutions

In the United States, companies that file reports with the Securities and Exchange Commission (SEC) must prepare their financial statements according to Generally Accepted Accounting Principles, or US GAAP. These rules provide the foundation for consistent, transparent, and comparable financial reporting across public companies.

Over the past decade, the SEC has added another layer to this requirement: not only must financial reports be published in human-readable formats like PDF or HTML, they must also be filed using XBRL. And while standardizing data in this way offers numerous benefits, tagging financial data for XBRL can be a challenge for accountants and analysts who are experts in accounting data – not markup languages.

Faced with these challenges, companies often turn to specialized tools to streamline US-GAAP XBRL tagging. One such solution is xbrl-tagging.com, which provides an easy, visual way for organizations to manage the complexities of structured reporting – and it’s free.

Understanding US-GAAP XBRL Reporting

XBRL is a global standard for structuring financial data. Instead of leaving numbers and disclosures locked in static documents, XBRL “tags” each reported item with metadata that explains what it represents. This makes financial data machine-readable so analysts, regulators, and investors can easily process, compare, and analyze information across companies and industries. To make this work, filers rely on the US GAAP Taxonomy, a massive library of thousands of standardized tags maintained by the Financial Accounting Standards Board (FASB). The taxonomy is basically a dictionary or blueprint that defines the meaning of each piece of financial data in a report. It specifies the concepts (like Revenue, Net Income, or Assets), how they relate to each other, and the rules for tagging them.

The taxonomy is updated regularly, and the SEC requires companies to use the latest version when preparing filings. Deprecated elements must be avoided, and in most cases filers are expected to select the standard tags that best describe each fact in their financial statements. In certain situations, however, a standard element may not capture the exact meaning of a disclosure, and filers are allowed to create custom tags. These extensions must be carefully anchored to existing elements in the taxonomy so the data remains comparable to peers. On top of taxonomy requirements, companies must also comply with the EDGAR Filing Manual and validation rules from the SEC and the XBRL US Data Quality Committee (DQC). These checks are designed to ensure facts are tagged correctly, calculations add up, time periods are applied properly, and dimensions are used consistently.

Below is a small snippet of an XBRL report tagged according to US GAAP requirements viewed in XMLSpy text view. The tags are listed inside the blue brackets that surround the reported data, which is in black font:

The Challenges of US-GAAP XBRL Tagging

On paper, the system seems straightforward: apply the right tag to each financial fact, check it against the rules, and submit the filing. In practice, however, XBRL reporting under US GAAP is anything but simple.

The first challenge is the sheer size and complexity of the US GAAP Taxonomy. With thousands of elements organized into networks of calculations, dimensions, and definitions, identifying the right tag often feels like searching for a needle in a haystack. Filers must not only understand the accounting rules behind their disclosures but also the precise meaning of taxonomy elements. Every year, when FASB releases updates, companies have to revisit their tagging choices, replace deprecated tags, and ensure they are using the most appropriate concepts.

Dimensional tagging poses similar hurdles. Dimensions allow filers to break down data into components, such as revenues by product line or region. Yet not every member can be used with every axis, and missteps are common. A company might, for instance, tag a geographic member under a product axis, or forget to apply a default member when required. Errors like these can distort the meaning of the data and trigger validation failures.

Contextual details can also trip up filers. Every XBRL fact must include information such as the reporting entity, the period it covers, and the units of measure. Mixing up duration versus instant elements, using the wrong unit, or tagging a fact with dates that don’t align to the fiscal year are common mistakes. While some of these issues can be caught by automated checks, they often require painstaking review.

Even when the mechanics of tagging are done correctly, companies face the challenge of reconciling human-readable financial statements with machine-readable ones. Disclosures that make sense in a footnote or a narrative paragraph do not always map neatly to the taxonomy. A table presented for investor clarity may not match the structure required for XBRL. This tension between usability for people and requirements for machines creates significant friction.

Perhaps the greatest challenge is the sheer workload involved. A filing must pass multiple layers of validation: SEC rules, FASB taxonomy checks, and Data Quality Committee guidance. Filers must review every error and warning, often under tight deadlines. The process demands not only accounting expertise but also a working knowledge of the technical rules of XBRL.

Without strong tools or expensive outsourcing, the risk of mistakes and the work they add is high.

How Specialized Solutions Can Help

As leader in the XBRL field for more than 15 years, Altova has developed numerous XBRL Certified software products in wide use by customers around the globe. During that time, we’ve heard from customers who need a friction-free way to add XBRL tags to annual financial statements that already exist in human-readable formats. In response, we created a free, cloud-based solution available at xbrl-tagging.com. The goal of a solution like this is to greatly simplify the tagging process while ensuring compliance with all applicable rules.

With Altova XBRL Tagging, you can generate US GAAP XBRL filings without the need for complicated software or specialized consultants. You can upload your company’s financial report together with your company’s extension taxonomy and begin tagging right away using a visual, point-and-click interface.

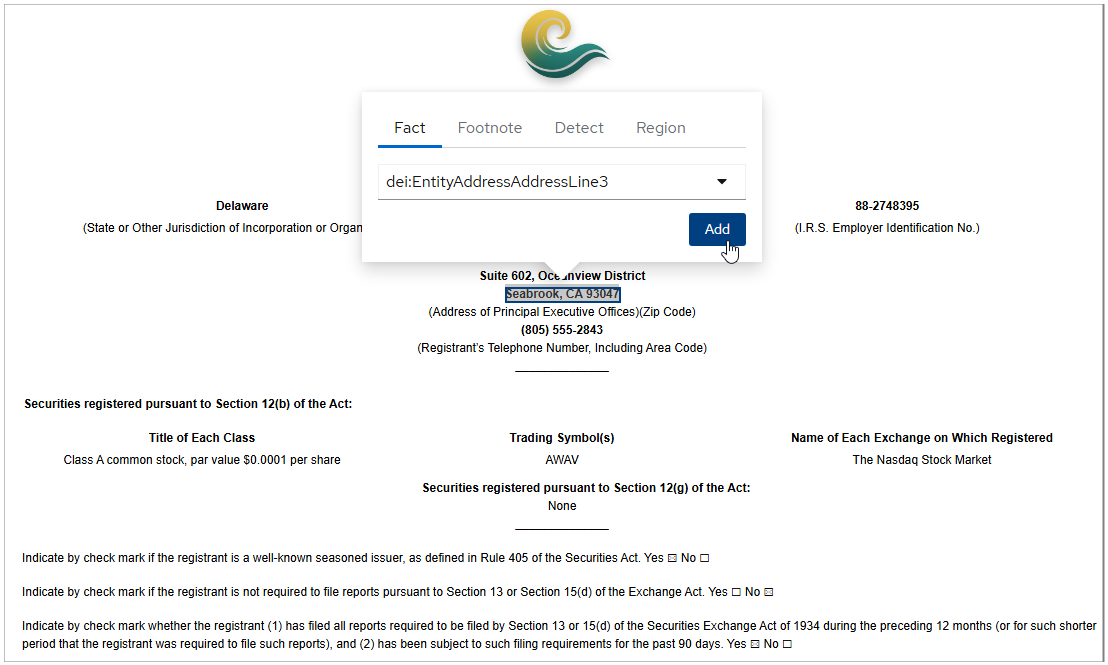

Instead of writing complex XBRL code, you select content directly in the report. A context-sensitive menu presents only the taxonomy elements that apply, making it easy to tag individual facts, annotate footnotes, or mark entire regions of data at once. The tool can even recognize tables automatically, saving countless hours on repetitive work.

As you progress, the Details pane keeps everything organized. It shows properties for each tagged fact, regions you’ve defined, footnotes you’ve added, and all linkroles associated with the taxonomy. The Linkroles tab also provides a clear view of what’s been tagged and what still needs attention, letting you jump to any fact instantly.

Once tagging is complete, you simply export your work and the software generates a fully compliant XBRL report that aligns with US GAAP requirements.

Here’s how it works:

Get Started in Seconds

While there are other XBRL tagging tools on the market, most require software installation, configuration, or training before they can be used. Altova XBRL Tagging avoids these barriers by running directly in the browser with no setup required: just go to xbrl-tagging.com and start tagging. It’s free, and you won’t even need to create an account or password to try it.