Additional Info

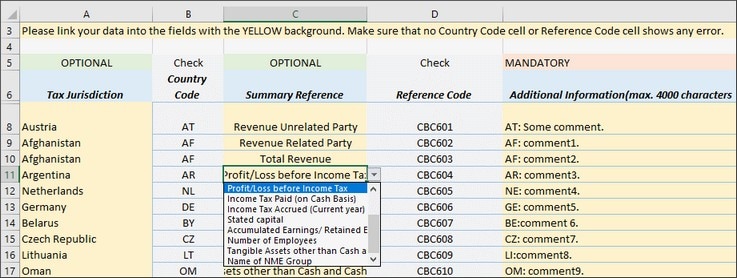

The Additional Info table (screenshot below) provides additional information about the Summary Reference items of a tax jurisdiction. For example, in the screenshot below, additional information has been provided for two summary reference items of the Afghanistan tax jurisdiction. The relevant summary reference item can be selected from the combo box of the Summary Reference cell (see screenshot).

Add data to this table as follows:

•Each summary reference of a tax jurisdiction is entered in a separate row. First select the country of tax jurisdiction from the dropdown list of the combo box that appears when you place the cursor in a cell of the Tax Jurisdiction column. The country code is entered automatically in the next column.

•In the Summary Reference column, select an item from the combo box (see screenshot above). The reference code (of the summary reference) is entered automatically in the next column.

•In the Additional Information column, enter the information for the selected summary reference item, up to a maximum of 4000 characters.

•Data in the cells need not be entered directly. You can also link to source Excel files (see Excel's data linking feature).

Where additional information is shown in the solution

After the Excel data has been imported into the CbCR solution, the additional information is displayed in the Additional Information tab of the report (see screenshot below). Each tax jurisdiction from the Excel template is displayed in a single row. For each summary reference of a tax jurisdiction, the comment from the Excel template is displayed. You can edit all these values if you like (tax jurisdiction, summary reference, and additional information).