XBRL Data Quality of SEC Filings in EDGAR

For fundamental investors probably the most important financial information to study are the financial reports from companies that they wish to potentially invest in. For publicly traded companies in the US, the SEC regulates what data needs to be reported and at which frequency, and investors typically access those financial reports through their own brokerage firm’s website, or through publicly available databases from other Internet providers. In addition, all the original filings from all companies are also directly available from the SEC in the EDGAR database. In addition to HTML and PDF versions of those financial reports, the EDGAR database also contains XBRL versions of those company filings since 2007, with the intent of making this data more easily comparable and directly consumable by computer programs for further analysis.

At least that is the goal…

In this article we’re going to look at some issues with the XBRL data quality of company filings in the SEC’s EDGAR database and show the surprising lack of correlation of high-level financial data extracted from the XBRL filings with publicly available financial data about US companies provided, e.g., by Yahoo Finance, Google Finance, and Fidelity Investments, as well as the shocking discrepancies found in the data reported by those separate services amongst one another.

Given how important these financial reports are for investors, one would assume that the financial data available on the various websites is close to 99% accurate and matches the actual company filing in XBRL format. However, that does not seem to be the case at all.

We have run a detailed comparison of the balance sheet data as reported on the the Google Finance, Yahoo Finance, and Fidelity Investments web pages. Those three services were randomly picked and we’re pretty confident that we would have found similar discrepancies had we picked three other services. For our test we have compared the recent quarterly filings from about 6,700 companies with ticker symbols in their XBRL filings to ensure a 100% correct match between CIK# – the identifier the SEC uses internally in the EDGAR database – and the more well-known stock ticker symbols.

As all these companies report their balance sheet data with slightly different breakdowns (more on that later in this post), we had to summarize the detail line items to make them comparable. We have also rounded the numbers to the nearest million if they were bigger than a million, otherwise to the nearest thousand.

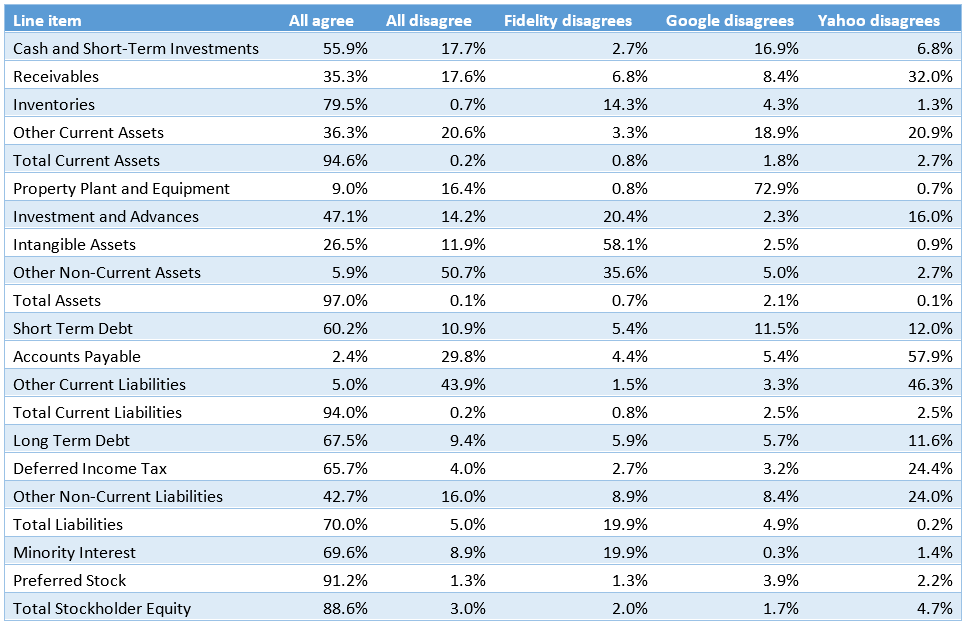

Correlation between financial services

Below is a table showing for each high-level line item on the balance sheet what percentage of company filings the three web sites reported the exact same number (column “All agree”). As you can see, for some major line items like Total Current Assets, Total Assets, and Total Current Liabilities the three web sites do indeed agree for 94% or more of the companies. But if you look at A/R and A/P data in Receivables or Accounts Payable, they only agree in 35% and 2.4% of the cases respectively. That should be of great concern to any investor!

The second column is also interesting, because it shows the percentage of companies in our sample where all three services disagree and report completely different data.

Last, but not least, the remaining three columns show the percentage where two providers had the same value but the third one had a different result in their report. Please also note that this table doesn’t actually say anything about which data provider is more correct, just the number of times they agree/disagree.

As mentioned above the major line items containing the totals on the assets and liabilities side of the balance sheet are usually fairly accurate and correlate well between the providers, as these are commonly reported directly in the corporate filing. But there is a lot of ambiguity for some of the more detailed line item breakdowns.

Also we’ve identified many cases where even the major totals such as Total Liabilities report numbers that may seem to be in the right ballpark, but the difference can still be an error of a few million or billion – sometimes even due to obvious typos resulting from manual data entry, such as some providers reporting Total Liabilities for SWC for 2014-12-31 as 468,000,000 vs. 486,000,000.

Correlation of XBRL data and services

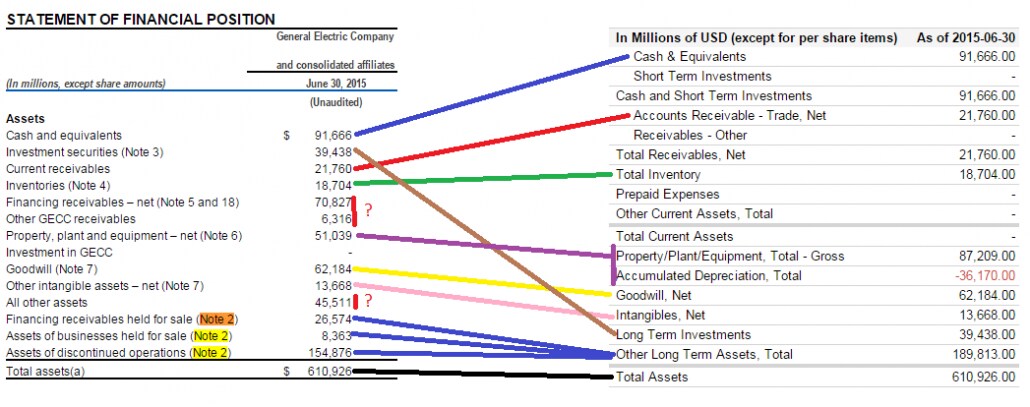

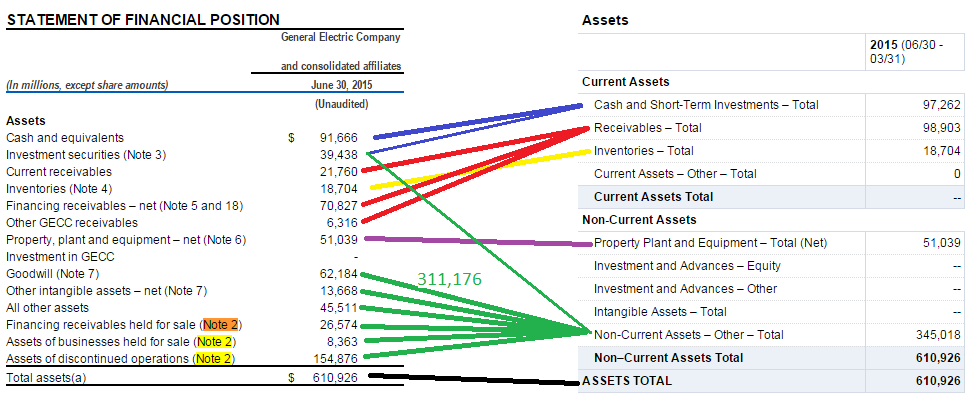

The actual breakdown of the major concepts like Assets into its constituent parts often differs quite dramatically. Here is a quick illustration using GE’s quarterly balance sheet from 2015-06-30. We have compared the Assets part of the official 10-Q balance sheet (left side) to the data on Google/Yahoo/Fidelity respectively (right side) and will discuss notable differences as well as show the mapping probably undertaken by these services, as far as we can deduce it:

Google Finance

One striking issue is that Google didn’t include all line items from the original balance sheet (see red bar and question marks on the left side) and thus the Google-reported line items don’t actually add up to their Total Assets sum! Also note that GE doesn’t provide an explicit current/non-current breakdown in their filing, but usually the more current assets are listed first in XBRL filings based on US-GAAP. However, it appears that Google has mapped the Investment securities line item into Long Term Investments.

One other interesting fact is that instead of reporting Property, plant, and equipment as a net number on the balance sheet, like the XBRL filing on the left shows, Google is providing a separation of gross property/plant/equipment minus depreciation, so more data than is actually reported in the XBRL balance sheet. The data for this breakdown is provided in Note 6 of the XBRL filing, but only in text form and not as XBRL facts, so it cannot be extracted from the XBRL file automatically and instead requires manual data entry by a human operator.

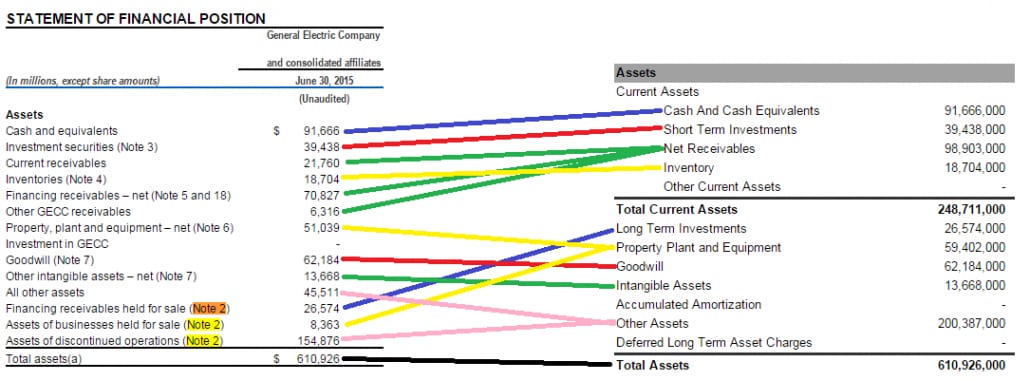

Yahoo Finance

Interestingly, Yahoo’s mapping from the official XBRL balance sheet to their representation seems to be quite logical and straightforward. The only exception is Assets of businesses held for sale which Yahoo has decided to add to Property/Plant/Equipment rather than Other Assets. However, in the grand scheme of things, that seems to be a minor distinction. At least their numbers add up and the balance sheet corresponds mostly to the XBRL balance sheet.

Fidelity Investments

Here the most striking feature is that only 5,596 of the Investment securities was attributed to Short-Term Investments, the remainder of 33,842 to Other Non-current Assets. There is nothing in the XBRL filing – not even in the Notes – that would hint at why this breakdown would be appropriate. Also Goodwill and other intangible assets were added to Other Non-current Assets instead of correctly showing them under Intangible Assets. In fact, the Other Non-current Assets line item appears to be a bit of catch-all in the balance sheet numbers shown by Fidelity.

As the above comparison has shown, Google’s data seems not reliable overall as their line items don’t even add up correctly to the totals given. Fidelity’s breakdown is not apparent and difficult to understand sometimes, and several items seem to simply be lumped together into the various “Other” line items rather than mapped exactly. From the perspective of correlation with XBRL company filings, Yahoo’s mapping appears to be the most straightforward and recognizable correlation.

If you would like to reference the source data used in this correlation, here are the links to the respective web sites and the exact pages references in the above diagrams:

- http://www.sec.gov/Archives/edgar/data/40545/000004054515000088/ge10q2q15.htm

- http://www.sec.gov/cgi-bin/viewer?action=view&cik=40545&accession_number=0000040545-15-000088&xbrl_type=v#

- https://eresearch.fidelity.com/eresearch/evaluate/fundamentals/financials.jhtml?stockspage=financials&symbols=GE&period=quarterly

- http://www.google.com/finance?q=NYSE%3AGE&fstype=ii&ei=92TIVYnrE4yKsgH6j4CoDw

- http://finance.yahoo.com/q/bs?s=GE

Analysis of XBRL Data Quality Issues

So the question arises: why is it so difficult to map all this financial data from XBRL into a high-level presentation that an investor can use to make good decisions? Wasn’t XBRL supposed to provide a reliable machine-readable form of the financial reports that could be used to better understand company filings?

In our experience with processing and analyzing all XBRL filings over the last several years, we’ve identified five major hurdles that make it extremely difficult to automatically process/extract data from the SEC XBRL company filings in the EDGAR database.

1. No standard mechanism to identify linkrole for a given report in extension taxonomies

There is no predefined linkrole for the balance sheet report and every company makes up a slightly different name. For example, here are just a few of the thousands of distinct linkrole endings:

‘ConsolidatedBalanceSheets’,’BalanceSheets’,’StatementOfFinancialPositionClassified’,’CondensedConsolidatedBalanceSheets’,’StatementConsolidatedBalanceSheets’,’StatementConsolidatedBalanceSheet’,’ConsolidatedBalanceSheet’,’StatementCondensedConsolidatedBalanceSheets’,’CondensedConsolidatedBalanceSheetsUnaudited’,’ConsolidatedBalanceSheetsUnaudited’,’BalanceSheet’,’BalanceSheetsUnaudited’,’CondensedBalanceSheets’,’StatementCONSOLIDATEDBALANCESHEETS’,’StatementCONSOLIDATEDBALANCESHEET’,’idr_BalanceSheets’,’idr_CONSOLIDATEDBALANCESHEETS’,’ConsolidatedStatementsOfFinancialCondition’,’StatementBalanceSheets’,’idr_ConsolidatedBalanceSheets’,’ConsolidatedCondensedBalanceSheets’,’ConsolidatedStatementsOfFinancialPosition’,’idr_BALANCESHEETS’,’UnauditedCondensedConsolidatedBalanceSheets’,’StatementCondensedBalanceSheets’,’StatementConsolidatedStatementsOfFinancialCondition’,’CondensedConsolidatedBalanceSheet’,’StatementCONDENSEDCONSOLIDATEDBALANCESHEETS’,’idr_StatementOfFinancialPosition’,’idr_CONDENSEDCONSOLIDATEDBALANCESHEETS’,’StatementsOfFinancialCondition’,’StatementCONDENSEDBALANCESHEETS’,’UnauditedConsolidatedBalanceSheets’,’idr_CondensedBalanceSheets’,’CondensedBalanceSheetsUnaudited’,’CondensedBalanceSheetsTable’,’CONSOLIDATEDBALANCESHEETS’,’idr_BalanceSheet’,’statement-condensed-consolidated-balance-sheets-current-period-unaudited’,’StatementOfFinancialPosition’,’CondensedConsolidatedBalanceSheetUnaudited’,’CondensedBalanceSheet’,’StatementCONDENSEDCONSOLIDATEDBALANCESHEETSUnaudited’,’StatementConsolidatedStatementsOfFinancialPosition’,’idr_BalanceSheetsUnaudited’,’CondensedConsolidatedStatementsOfFinancialPosition’,’StatementBALANCESHEETS’,’idr_CONSOLIDATEDBALANCESHEETSUnaudited’,’StatementConsolidatedCondensedBalanceSheets’,’StatementsOfFinancialConditionUnaudited’,’StatementConsolidatedBalanceSheetsUnaudited’,’CondensedStatementsOfFinancialCondition’,’idr_CondensedConsolidatedBalanceSheets’,’ConsolidatedStatementsOfFinancialConditionUnaudited’,’Consolidatedbalancesheets’,’idr_CONDENSEDBALANCESHEETS’,’ConsolidatedCondensedBalanceSheetsUnaudited’,’StatementCondensedConsolidatedBalanceSheetsUnaudited’,’ConsolidatedBalanceSheetUnaudited’,’CondensedConsolidatedStatementsOfFinancialCondition’,’ConsolidatedStatementsOfCondition’,’StatementStatementsOfFinancialCondition’

In reality one needs to implement a sophisticated string matching heuristics algorithm and include the roleType definition string, which yields slightly less variation, e.g., searching for the words ‘Balance’ and ‘Sheet’. This is obviously not 100% reliable and one also has to deal with spelling errors in the linkroles, e.g., “Sheeets”.

2. Calculation linkbases are typically too flat in extension taxonomies

The companies typically provide only a breakdown of the top level concepts like Assets or Liabilities, and maybe an additional breakdown for Current/Non-current Assets/Liabilities, but they don’t provide enough detail to know how to compute the other important balance sheet line items, such as Accounts Receivable, Prepaid Expenses, etc.

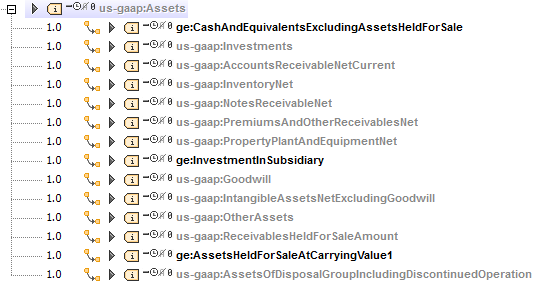

This is especially problematic when custom concepts are included in an extension taxonomy that are then not properly included in the calculation linkbase of said extension taxonomy. For example, here is an excerpt of the calculation linkbase from GE’s filing that we used in the above mappings:

3. US-GAAP standard calculation linkbase often not applicable

The US-GAAP taxonomy provides templates for the balance sheet calculation linkbase which have a very detailed and deep breakdown of Assets and Liabilities. This would be perfect for our purposes as their breakdown often matches well with the line items that we as investors are interested in.

Unfortunately, however, the standard calculation linkbase cannot be reliably applied to all XBRL filings because (a) standard concepts are not used consistently, (b) sometimes the extension calculation linkbase redefines this hierarchy, and (c) the standard calculation linkbase doesn’t help with additional custom concepts introduced in extension taxonomies.

Below are just a few small excerpts from the standard calculation linkbase annotated with the line items in the Yahoo Finance website reports that these concepts were added to respectively. This is an example from the Liabilities side of the balance sheet report:

Liabilities

LiabilitiesCurrent

AccountsPayableAndAccruedLiabilitiesCurrent x1267 Accounts Payable, x4 Other Current Liabilities, x2 Short/Current Long Term Debt

AccruedLiabilitiesCurrent x5042 Accounts Payable, x21 Other Current Liabilities, x7 Short/Current Long Term Debt, x1 Other Liabilities

AccruedAdvertisingCurrent x33 Accounts Payable

AccruedInsuranceCurrent x51 Accounts Payable

AccruedLiabilitiesForUnredeeemedGiftCards x18 Other Current Liabilities

AccruedMarketingCostsCurrent x45 Accounts Payable

AccruedProfessionalFeesCurrent x19 Accounts Payable, x4 Other Current Liabilities

AccruedRentCurrent x14 Accounts Payable, x2 Short/Current Long Term Debt

AccruedRoyaltiesCurrent x96 Accounts Payable, x8 Other Current Liabilities, x4 Short/Current Long Term Debt

AccruedSalesCommissionCurrent x30 Short/Current Long Term Debt, x25 Accounts Payable, x4 Other Liabilities

AccruedUtilitiesCurrent x3 Accounts Payable

LeaseIncentivePayableCurrent x5 Other Current Liabilities, x3 Short/Current Long Term Debt

OtherAccruedLiabilitiesCurrent x996 Accounts Payable, x69 Other Current Liabilities, x8 Short/Current Long Term Debt

ProductWarrantyAccrualClassifiedCurrent x119 Accounts Payable, x56 Other Current Liabilities

StandardProductWarrantyAccrualCurrent x15 Accounts Payable, x8 Other Current LiabilitiesAs an illustrative example, take a look at the AccruedSalesCommissionCurrent concept, which was added to Short/Current Long Term Debt in 30 filings, Accounts Payable in 25 filings and to Other Liabilities in 4 filings. Looking at the numbers above, the concepts under AcrruedLiabilitiesCurrent are usually added to Accounts Payable, but not always. Also there are a lot of concepts that have a distinction between current and non-current. The parent concept is supposed to contain the total sum but in practice is often used instead of one or the other, e.g.:

SecuredDebt x57 Long Term Debt, x12 Short/Current Long Term Debt, x2 Other Current Liabilities, x1 Other Liabilities

SecuredDebtCurrent x22 Short/Current Long Term Debt, x5 Other Current Liabilities

SecuredLongTermDebt x36 Long Term Debt, x4 Other Liabilities OtherLiabilities x93 Other Liabilities, x11 Accounts Payable, x5 Other Current Liabilities, x3 Deferred Long Term Liability Charges

OtherLiabilitiesCurrent x596 Other Current Liabilities, x125 Accounts Payable, x13 Short/Current Long Term Debt, x5 Other Liabilities

OtherLiabilitiesNoncurrent x1916 Other Liabilities, x27 Deferred Long Term Liability Charges, x8 Long Term Debt, x1 Other Stockholder EquityAs you can see, extracting reliable high-level financial report data that is useful to investors and that can easily be utilized for comparative analysis between multiple companies is very difficult even today.

4. The real information is in the labels

The sad truth is – and this brings us back to the headline of this post – that even though XBRL financial reports have been mandated for many years now, a lot of public companies still see it as an after-thought and simply take their HTML filings and produce the XBRL instance by quick&dirty tagging of the numbers with one of the standard concepts from the US-GAAP taxonomy using one of the many tagging solutions on the market. If not enough care is taken to pick out the most applicable concept out of the 15k predefined concepts, then the data quality of the resulting XBRL suffers immensely and the usefulness of the data to an investor becomes questionable. In our experience, extracting information with rules using only concept names cannot be 100% reliable. One would need to parse/analyze the concept labels (which are copied from the original HTML), which leads the whole idea of taxonomies and calculation linkbase ad absurdum. Here are a few such examples which are impossible to map to the correct high-level financial line item just from the concept name:

| Concept | Label | High-level line item (on Yahoo) |

| us-gaap:OtherAssetsNoncurrent | Investments and sundry assets | Long Term Investments |

| us-gaap:OtherLiabilitiesCurrent | Other accrued expenses and liabilities | Accounts Payable |

5. Too many custom concepts

The list below shows all the concepts that were involved (in at least one filing) in calculating the Cash And Cash Equivalents line item (extracted from matching facts) and in how many company filings this concept was encountered just in 2015. The concepts without namespace are predefined standard US-GAAP concepts; the concepts with namespaces are company extension taxonomy concepts we encountered. Please note that this list is not fully complete and also varies from year to year and one software version to the next of the tagging solutions that are being used by companies:

Cash And Cash Equivalents

CashAndCashEquivalentsAtCarryingValue 10189

RestrictedCashAndCashEquivalentsAtCarryingValue 1241

RestrictedCashAndCashEquivalents 643

Cash 417

RestrictedCashAndInvestmentsCurrent 180

CashEquivalentsAtCarryingValue 43

RestrictedInvestmentsCurrent 29

CashAndCashEquivalentsAtCarryingValueIncludingDiscontinuedOperations 21

EquityMethodInvestments 20

RestrictedCashAndInvestments 17

AvailableForSaleSecurities 15

FundsHeldForClients 13

FinancialInstrumentsOwnedMortgagesMortgageBackedAndAssetBackedSecuritiesAtFairValue 12

InterestBearingDepositsInBanks 12

CashAndDueFromBanks 11

CashAndSecuritiesSegregatedUnderFederalAndOtherRegulations 10

MarginDepositAssets 10

FederalHomeLoanBankStock 8

CashCollateralForBorrowedSecurities 7

DepositsAssets 7

DepositsAssetsCurrent 6

CashAndCashEquivalentsFairValueDisclosure 6

CertificatesOfDepositAtCarryingValue 6

MarketableSecuritiesRestrictedCurrent 5

EscrowDeposit 5

RestrictedCashAndCashEquivalentsNoncurrent 4

DepositAssets 4

RestrictedInvestmentsNoncurrent 4

MortgageLoansOnRealEstateCommercialAndConsumerNet 4

SecuritiesForReverseRepurchaseAgreements 4

HeldToMaturitySecuritiesRestricted 4

CashCashEquivalentsAndFederalFundsSold 4

HeldtomaturitySecuritiesRestrictedCurrent 4

AvailableForSaleSecuritiesRestricted 3

ServicingAssetAtFairValueAmount 3

DerivativeAssetsCurrent 3

OtherRestrictedAssetsCurrent 3

CarryingValueOfFederalFundsSoldSecuritiesPurchasedUnderAgreementsToResellAndDepositsPaidForSecuritiesBorrowed 3

PrepaidExpenseAndOtherAssetsCurrent 3

MarketableSecuritiesEquitySecurities 3

ReplacementReserveEscrow 3

EarnestMoneyDeposits 3

RestrictedInvestments 2

AvailableForSaleSecuritiesDebtSecuritiesNoncurrent 2

AvailableForSaleSecuritiesPledgedAsCollateral 2

FinancialInstrumentsOwnedStateAndMunicipalGovernmentObligationsAtFairValue 2

AssetsHeldInTrustNoncurrent 2

OtherRestrictedAssets 2

TradingSecuritiesPledgedAsCollateral 2

ShortTermInvestments 1

HeldToMaturitySecurities 1

PledgedAssetsSeparatelyReportedMortgageRelatedSecuritiesAvailableForSaleOrHeldForInvestment 1

USGovernmentSecuritiesAtCarryingValue 1

MortgageBackedSecuritiesAvailableForSaleFairValueDisclosure 1

{http://www.voya.com/20140930}:CashAndCashEquivalentsConsolidatedInvestmentEntities 2

{http://www.copt.com/20140930}:RestrictedCashAndMarketableSecurities 1

{http://www.carlyle.com/20140630}:RestrictedCashAndCashEquivalentsAndSecuritiesOfConsolidatedFunds 1

{http://www.virtus.com/20141231}:CashPledgedOrOnDepositOfConsolidatedSponsoredInvestmentProducts 1

{http://www.intgla.com/20150331}:RestrickedCashMortgageImpounds 1

{http://www.dunkinbrands.com/20150328}:RestrictedAssetsOfAdvertisingFunds 1

{http://www.intgla.com/20141231}:RestrictedCashRedemption 1

{http://www.carlyle.com/20150331}:RestrictedCashAndCashEquivalentsAndSecuritiesOfConsolidatedFunds 1

{http://www.kkr.com/20140930}:CashAndCashEquivalentsHeldAtConsolidatedEntities 1

{http://www.intgla.com/20140630}:RestrictedCashRedemption 1

{http://www.nelnet.com/20140630}:CashAndCashEquivalentsNotHeldAtRelatedParty 1

{http://www.lazard.com/20141231}:DepositsWithBanksAndShortTermInvestments 1

{http://www.aecom.com/20140930}:CashAndCashEquivalentsGeneral 1

{http://www.dstsystems.com/20140930}:RestrictedCashAndCashEquivalentsAtCarryingValueOnBehalfOfClients 1

{http://www.vaalco.com/20140630}:FundsInEscrowCurrent 1

{http://igt.com/20140930}:RestrictedCashAndInvestmentSecuritiesOfVIEs 1

{http://www.linkp.com/20141231}:CashAndCashEquivalentsExcludingCertificatesOfDeposit 1

{http://www.nelnet.com/20141231}:CashAndCashEquivalentsRelatedParty 1

{http://www.anworth.com/20140630}:AgencyMortgageBackedSecuritiesAtFairValue 1

{http://www.eatonvance.com/20150131}:CashAndCashEquivalentsConsolidatedVariableInterestEntity 1

{http://www.wendys.com/20141228}:AdvertisingFundsRestrictedAssets 1

{http://www.invesco.com/20150630}:CashAndCashEquivalentsOfConsolidatedInvestmentProducts 1

{http://www.dunkinbrands.com/20140628}:RestrictedAssetsOfAdvertisingFunds 1

{http://corp.sohu.com/20141231}:RestrictedTimeDepositsCurrent 1

{http://www.dstsystems.com/20140630}:RestrictedCashAndCashEquivalentsAtCarryingValueOnBehalfOfClients 1

{http://www.firstmarblehead.com/20140930}:DepositsForParticipationInterestAccounts 1

{http://www.nelnet.com/20150331}:CashAndCashEquivalentsNotHeldAtRelatedParty 1

{http://www.orchidislandcapital.com/20140930}:MortgageBackedSecuritiesAtFairValueUnpledged 1

{http://www.orm.com/20140930}:CashAndCashEquivalentsAtCarryingValueFundCompany 1

{http://www.virtus.com/20150331}:CashPledgedOrOnDepositOfConsolidatedSponsoredInvestmentProducts 1

{http://www.kennedywilson.com/20140630}:CashHeldbyConsolidatedInvestments 1

{http://www.ultrapetroleum.com/20150331}:RestrictedCash 1

{http://www.pnkinc.com/20141231}:CashandCashEquivalentsExcludingDiscontinuedOperations 1

{http://www.copt.com/20150331}:RestrictedCashAndMarketableSecurities 1

{http://www.orchidislandcapital.com/20150630}:MortgageBackedSecuritiesAtFairValuePledgedAsCollateral 1

{http://www.orm.com/20141231}:CashAndCashEquivalentsAtCarryingValueParent 1

{http://www.lazard.com/20150331}:DepositsWithBanksAndShortTermInvestments 1

{http://www.nelnet.com/20141231}:CashAndCashEquivalentsNotHeldAtRelatedParty 1

{http://www.virtus.com/20150630}:CashAndCashEquivalentsOfConsolidatedSponsoredInvestmentProducts 1

{http://www.orchidislandcapital.com/20140930}:MortgageBackedSecuritiesAtFairValuePledgedAsCollateral 1

{http://www.kennedywilson.com/20140930}:CashHeldbyConsolidatedInvestments 1

{http://www.zionoil.com/20140930}:DepositsAssetsRestrictedCurrent 1

{http://www.anworth.com/20141231}:AgencyMortgageBackedSecuritiesAtFairValue 1

{http://www.orchidislandcapital.com/20150331}:MortgageBackedSecuritiesAtFairValueUnpledged 1

{http://www.orm.com/20140930}:CashAndCashEquivalentsAtCarryingValueParent 1

{http://www.kennedywilson.com/20140930}:CashandCashEquivalentsExcludingCashHeldbyConsolidatedInvestments 1

{http://www.nwbio.com/20140630}:CashInCustodyAccount 1

{http://www.kennedywilson.com/20150331}:CashandCashEquivalentsExcludingCashHeldbyConsolidatedInvestments 1

{http://www.qtww.com/20150331}:CashAndCashEquivalentsOfContinuingOperationsAtCarryingValue 1

{http://burlingtoncg.com/20150331}:AvailableForSaleSecuritiesFairValueDisclosureMortgageBackedSecurities 1

{http://www.sunedison.com/20141231}:CashCommittedforConstructionProjects 1

{http://burlingtoncg.com/20140930}:AvailableForSaleSecuritiesFairValueDisclosureMortgageBackedSecurities 1

{http://www.nelnet.com/20140630}:CashAndCashEquivalentsRelatedParty 1

{http://www.sunedison.com/20140930}:CashCommittedforConstructionProjects 1

{http://www.orm.com/20150331}:CashAndCashEquivalentsAtCarryingValueFundCompany 1

{http://www.wendysarbys.com/20140629}:AdvertisingFundsRestrictedAssets 1

{http://www.cnoinc.com/20150331}:CashAndCashEquivalentsHeldByVariableInterestEntities 1

{http://www.ultrapetroleum.com/20150630}:RestrictedCash 1

{http://www.intgla.com/20140630}:RestrickedCashMortgageImpounds 1

{http://www.cnoinc.com/20140930}:CashAndCashEquivalentsHeldByVariableInterestEntities 1

{http://www.kkr.com/20150331}:CashAndCashEquivalentsHeldAtConsolidatedEntities 1

{http://www.kennedywilson.com/20150331}:CashHeldbyConsolidatedInvestments 1

{http://www.kennedywilson.com/20141231}:CashandCashEquivalentsExcludingCashHeldbyConsolidatedInvestments 1

{http://www.virtus.com/20150630}:CashPledgedOrOnDepositOfConsolidatedSponsoredInvestmentProducts 1

{http://www.intgla.com/20140930}:RestrickedCashMortgageImpounds 1

{http://www.aircastle.com/20150331}:RestrictedLiquidityFacilityCollateral 1

{http://www.buffalowildwings.com/20150628}:RestrictedAssetsCurrent 1

{http://www.altera.com/20150626}:DeferredCompensationPlanRestrictedCashEquivalents 1

{http://www.intgla.com/20141231}:RestrickedCashMortgageImpounds 1

{http://www.voya.com/20150331}:CashAndCashEquivalentsConsolidatedInvestmentEntities 1

{http://aircastle.com/20140630}:RestrictedLiquidityFacilityCollateral 1

{http://www.virtus.com/20140930}:CashPledgedOrOnDepositOfConsolidatedSponsoredInvestmentProducts 1

{http://www.kkr.com/20140630}:CashAndCashEquivalentsHeldAtConsolidatedEntities 1

{http://www.sunedison.com/20150331}:CashCommittedforConstructionProjects 1

{http://www.orm.com/20140630}:CashAndCashEquivalentsAtCarryingValueFundCompany 1

{http://www.altera.com/20150327}:DeferredCompensationPlanRestrictedCashEquivalents 1

{http://www.orchidislandcapital.com/20150630}:MortgageBackedSecuritiesAtFairValueUnpledged 1

{http://www.pnkinc.com/20140630}:CashandCashEquivalentsExcludingDiscontinuedOperations 1

{http://www.carlyle.com/20150331}:CashAndCashEquivalentsAtCarryingValueHeldAtConsolidatedFunds 1

{http://www.tecogen.com/20140630}:CertificateOfDepositsFairValueDisclosure 1

{http://www.carlyle.com/20140630}:CashAndCashEquivalentsAtCarryingValueHeldAtConsolidatedFunds 1

{http://www.ge.com/20150630}:CashAndEquivalentsExcludingAssetsHeldForSale 1

{http://www.dunkinbrands.com/20140927}:RestrictedAssetsOfAdvertisingFunds 1

{http://corp.sohu.com/20150331}:RestrictedTimeDepositsCurrent 1

{http://www.linkp.com/20150331}:CashAndCashEquivalentsExcludingCertificatesOfDeposit 1

{http://www.newresi.com/20140930}:ConsumerLoanEquityMethodInvestments 1

{http://igt.com/20140630}:RestrictedCashAndInvestmentSecuritiesOfVIEs 1

{http://www.buffalowildwings.com/20141228}:RestrictedAssetsCurrent 1

{http://www.dunkinbrands.com/20141227}:RestrictedAssetsOfAdvertisingFunds 1

{http://www.vaalco.com/20140930}:FundsInEscrowCurrent 1

{http://www.altera.com/20140926}:DeferredCompensationPlanRestrictedCashEquivalents 1

{http://www.wendys.com/20140928}:AdvertisingFundsRestrictedAssets 1

{http://carlyle.com/20141231}:RestrictedCashAndCashEquivalentsAndSecuritiesOfConsolidatedFunds 1

{http://www.copt.com/20141231}:RestrictedCashAndMarketableSecurities 1

{http://www.kkr.com/20141231}:CashAndCashEquivalentsHeldAtConsolidatedEntities 1

{http://www.tecogen.com/20150331}:CertificateOfDepositsFairValueDisclosure 1

{http://www.firstmarblehead.com/20141231}:DepositsForParticipationInterestAccounts 1

{http://www.nelnet.com/20140930}:CashAndCashEquivalentsNotHeldAtRelatedParty 1

{http://www.linkp.com/20140630}:CashAndCashEquivalentsExcludingCertificatesOfDeposit 1

{http://www.burlingtoncg.com/20140630}:AvailableForSaleSecuritiesFairValueDisclosureMortgageBackedSecurities 1

{http://www.lazard.com/20140930}:DepositsWithBanksAndShortTermInvestments 1

{http://www.anworth.com/20141231}:MortgageBackedSecuritiesIssuedByPrivateEntities 1

{http://www.apolloresidentialmortgage.com/20140930}:AvailableforsaleResidentialMortgageBackedSecurities 1

{http://www.orm.com/20140630}:CashAndCashEquivalentsAtCarryingValueParent 1

{http://www.intgla.com/20140930}:RestrictedCashRedemption 1

{http://igt.com/20141231}:RestrictedCashAndInvestmentSecuritiesOfVIEs 1

{http://www.ultrapetroleum.com/20140930}:RestrictedCash 1

{http://www.virtus.com/20141231}:CashAndCashEquivalentsOfConsolidatedSponsoredInvestmentProducts 1

{http://www.apolloresidentialmortgage.com/20140630}:AvailableforsaleResidentialMortgageBackedSecurities 1

{http://www.orm.com/20150331}:CashAndCashEquivalentsAtCarryingValueParent 1

{http://www.calpine.com/20140930}:MarginDepositsAndOtherPrepaidExpenses 1

{http://www.orchidislandcapital.com/20141231}:MortgageBackedSecuritiesAtFairValueUnpledged 1

{http://corp.sohu.com/20140630}:RestrictedTimeDepositsCurrent 1

{http://www.aircastle.com/20141231}:RestrictedLiquidityFacilityCollateral 1

{http://www.kennedywilson.com/20141231}:CashHeldbyConsolidatedInvestments 1

{http://www.buffalowildwings.com/20150329}:RestrictedAssetsCurrent 1

{http://www.eatonvance.com/20141031}:CashAndCashEquivalentsConsolidatedVariableInterestEntity 1

{http://www.virtus.com/20140930}:CashAndCashEquivalentsOfConsolidatedSponsoredInvestmentProducts 1

{http://www.pnkinc.com/20140930}:CashandCashEquivalentsExcludingDiscontinuedOperations 1

{http://www.tecogen.com/20140930}:CertificateOfDepositsFairValueDisclosure 1

{http://carlyle.com/20141231}:CashAndCashEquivalentsAtCarryingValueHeldAtConsolidatedFunds 1

{http://www.newresi.com/20150331}:ExcessMortgageServicingRightsEquityMethodInvesteesFairValue 1

{http://www.qtww.com/20140930}:CashAndCashEquivalentsOfContinuingOperationsAtCarryingValue 1

{http://www.newresi.com/20150331}:ExcessMortgageServicingRightsFairValue 1

{http://www.sunedison.com/20140630}:CashCommittedforConstructionProjects 1

{http://americanrealtycap.com/20140930}:PreferredEquityInvestment 1

{http://www.linkp.com/20140930}:CashAndCashEquivalentsExcludingCertificatesOfDeposit 1

{http://www.nelnet.com/20140930}:CashAndCashEquivalentsRelatedParty 1

{http://www.orchidislandcapital.com/20141231}:MortgageBackedSecuritiesAtFairValuePledgedAsCollateral 1

{http://www.voya.com/20140630}:CashAndCashEquivalentsConsolidatedInvestmentEntities 1

{http://www.orm.com/20141231}:CashAndCashEquivalentsAtCarryingValueFundCompany 1

{http://www.eatonvance.com/20150430}:CashAndCashEquivalentsConsolidatedVariableInterestEntity 1

{http://www.lazard.com/20150630}:DepositsWithBanksAndShortTermInvestments 1

{http://www.altera.com/20141231}:DeferredCompensationPlanRestrictedCashEquivalents 1

{http://www.invesco.com/20150331}:CashAndCashEquivalentsOfConsolidatedInvestmentProducts 1

{http://www.wendys.com/20150329}:AdvertisingFundsRestrictedAssets 1

{http://www.qtww.com/20140630}:CashAndCashEquivalentsOfContinuingOperationsAtCarryingValue 1

{http://www.kennedywilson.com/20140630}:CashandCashEquivalentsExcludingCashHeldbyConsolidatedInvestments 1

{http://www.aircastle.com/20140930}:RestrictedLiquidityFacilityCollateral 1

{http://www.buffalowildwings.com/20140928}:RestrictedAssetsCurrent 1

{http://www.firstmarblehead.com/20150331}:DepositsForParticipationInterestAccounts 1

{http://www.eatonvance.com/20140731}:CashAndCashEquivalentsConsolidatedVariableInterestEntity 1

{http://www.nelnet.com/20150331}:CashAndCashEquivalentsRelatedParty 1

{http://corp.sohu.com/20140930}:RestrictedTimeDepositsCurrent 1

{http://orbcomm.com/20141231}:CashHeldForAcquisitionCurrent 1

{http://www.virtus.com/20150331}:CashAndCashEquivalentsOfConsolidatedSponsoredInvestmentProducts 1

{http://www.invesco.com/20141231}:CashAndCashEquivalentsOfConsolidatedInvestmentProducts 1

{http://www.americanrealtycap.com/20140630}:PreferredEquityInvestment 1

{http://www.invesco.com/20140930}:CashAndCashEquivalentsOfConsolidatedInvestmentProducts 1

{http://www.dstsystems.com/20141231}:RestrictedCashAndCashEquivalentsAtCarryingValueOnBehalfOfClients 1

{http://www.cnoinc.com/20141231}:CashAndCashEquivalentsHeldByVariableInterestEntities 1

{http://www.pnkinc.com/20150331}:CashandCashEquivalentsExcludingDiscontinuedOperations 1

{http://www.firstmarblehead.com/20140630}:ParticipationInterestAccount 1

{http://www.orchidislandcapital.com/20150331}:MortgageBackedSecuritiesAtFairValuePledgedAsCollateral 1

{http://www.aecom.com/20140630}:CashAndCashEquivalentsGeneral 1

{http://www.newresi.com/20140630}:ConsumerLoanEquityMethodInvestments 1Conclusion

As we have demonstrated, deriving reliable high-level financial data for investors from XBRL company filings available in the SEC’s EDGAR database is generally more difficult than necessary and unfortunately not 100% reliable.

However, we were quite surprised in our tests to find that the financial reporting data available from websites such as Google Finance, Yahoo Finance, and Fidelity Investments is also not 100% reliable, and we found numerous cases where the data reported by these sites does not correlate well with one another nor with the actual company filings themselves, which appears to be largely due to the five issues we’ve discussed above.

We are certainly not alone in reaching these conclusions about the current state of the art of XBRL data quality in the SEC’s EDGAR database. As @CharlesHoffman has written about in numerous blog posts filed under “CREATING INVESTOR FRIENDLY SEC XBRL FILINGS” on his Digital Financial Reporting site, there is a lot of work to be done to improve the data quality and accuracy of XBRL company filings submitted to the SEC.

Several immediate approaches come to mind that could greatly enhance XBRL data quality:

- Utilizing XBRL Formula to implement many of the EDGAR filer manual checks and many more consistency checks and business-level validations directly using the XBRL standard rather than in an external format that cannot be fully automated

- Utilizing XBRL Table Linkbase to produce a better and more clearly documented mappings from XBRL facts to high-level financial concepts that are needed by investors

- Requiring that companies produce the XBRL instance filings as a first-class financial document – directly from their accounting systems – rather than tagging HTML or PDF files after the fact

- Requiring filers to run their XBRL instance documents through a rigorous and automated validation and quality check process, such as the XBRL.US Consistency Suite, or using Altova’s RaptorXML+XBRL Server, which provides not only full XBRL standard validation, but also complete EDGAR filer manual validation and can be used either inside XMLSpy interactively for XBRL validation, or in an automated server environment for the high-speed validation of large amounts of XBRL data

- Finally implementing a rigorous quality check in the EDGAR systems at the SEC itself that only accepts XBRL filings in the first place if they are not only error-free and fully compliant with the specs, but also pass the above-mentioned data quality checks

Only through a combination of several of these approaches can we succeed in improving XBRL data quality and making the XBRL company filings truly useful for investors.

Corollary

Seeing how the fundamental investor who wants to find reliable corporate data today apparently has no choice but to go through the difficult exercise of researching a company on multiple sites and potentially going to the original source filings in HTML or PDF format, too, we plan to soon make publicly available a mobile solution – built with MobileTogether as a front-end and RaptorXML+XBRL Server as well as a SQL database as a back-end – that allows a potential investor to quickly look at high-level data from the last quarterly and annual filings of these public companies, which will be extracted straight from the XBRL filings and summarized for better comparability using heuristics matching.

Given the restrictions in the data quality discussed above, this data will not be perfect either, but we believe it will be a better match to the intent of the XBRL filings approach and that the data will only improve over time, as XBRL data quality continues to improve.