How to Implement EBA XBRL Data Quality Checks

The European Banking Authority (EBA) requires banks to use the XBRL data format for their filings. XBRL is a standardized format that makes it easier to collect, analyze, and compare data from different financial institutions. By adhering to the EBA XBRL taxonomy, banks submit data that is consistent and easy to validate, which simplifies the reporting process for both filing institutions and regulators. This streamlined approach improves reporting accuracy and helps the EBA maintain better oversight of the European banking sector.

In addition to required validations in the EBA XBRL Taxonomy, the EBA recommends a set of optional data quality checks that allow reporting organizations to further improve data accuracy and compliance with regulatory requirements. These extra validations help filing companies improve the accuracy and integrity of their reported data – but only if the checks are supported by their XBRL reporting tools.

As part of its comprehensive XBRL support, Altova can run the optional EBA XBRL data quality checks in multiple products. Let’s see how it works.

What are EBA Data Quality Checks?

The EBA is an independent EU authority tasked with regulating and supervising the banking sector across the EU. Its primary objectives include maintaining financial stability, ensuring the integrity of the banking system, and protecting consumers. To achieve these goals, the EBA requires financial institutions to submit reports in XBRL format, following its specific XBRL taxonomy.

By adopting XBRL, a standardized and widely-used reporting technology, the EBA enhances data transparency, accuracy, and accessibility. This allows regulators to efficiently assess financial stability across institutions. However, the detailed and highly structured nature of XBRL filings makes data quality critical.

To address this, the EBA has defined optional XBRL data quality checks. These can be run on top of its mandatory validation rules. These checks help organizations verify that their filings meet regulatory requirements and conform to formatting standards, and this helps reduce errors and increase the reliability of reported data. Implementing these additional checks offers several benefits:

- Error prevention: Early identification of inconsistencies or errors improves the quality of submitted data.

- Enhanced compliance: Strengthened adherence to regulatory standards minimizes compliance risks.

- Flexibility: Because the checks are optional, institutions can tailor their use of additional checks to align with their risk profiles and operational priorities.

For financial and IT professionals responsible for managing these filings, understanding the role of EBA XBRL and how data quality checks benefit the filing process is essential. Choosing the right XBRL tools that support the EBA taxonomy and optional checks can streamline the filing process, reduce errors, and ensure compliance with regulatory standards. This not only simplifies workflows but also strengthens confidence in meeting reporting requirements.

Specialized EBA XBRL Tools

Altova XBRL tools support EBA XBRL in multiple ways, from high-performance validation to easy XBRL report creation for business users. Now, all these products also support optional EBA XBRL data quality checks.

Generate EBA XBRL in Excel

While XBRL offers significant benefits, its complex syntax is often unfamiliar to the financial professionals responsible for recording and reporting EBA data. On the other hand, most business and technical users are well-versed in Excel. To bridge this gap, Altova created the EBA XBRL Add-in for Excel.

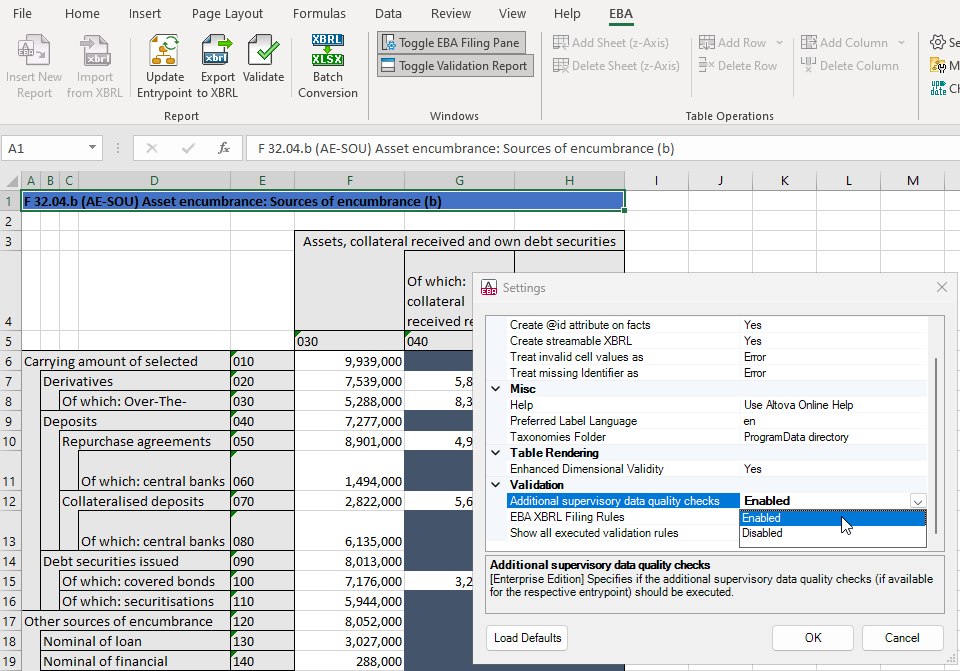

This add-in integrates seamlessly with Excel, adding a new EBA tab to the ribbon. From this tab, users can access a feature-rich Excel template, EBA filing pane, and context-sensitive entry helpers. These tools guide users step-by-step through the process of creating an EBA XBRL report—all without needing to interact with the underlying XBRL code.

It’s easy to start from scratch or import existing assets to complete the template. You can import information via Excel formulas or simply copy/paste it into the correct cells. Or, this template can replace your previous tracking spreadsheets, and you can simply update the information here going forward.

As you work, information is validated against the EBA 3.5 reporting framework and any number of local taxonomies customized for European countries, including:

- Belgium

- England

- France

- Germany

- Ireland

- Netherlands

- Portugal

The add-in also includes the option to run the optional EBA XBRL data quality checks when they are available for the corresponding entry point.

Any errors are reported in the validation pane with links to the affected cells for easy troubleshooting.

Validation of EBA Data Quality Checks

For more technical users, Altova offers developer tools and server software products that support EBA XBRL and the optional data quality checks.

- XMLSpy: This XML editor includes comprehensive XBRL editing and validation tools, including the ability to view, edit, and validate EBA XBRL reports. Unlike many other XBRL tools, XMLSpy also includes the option to enable validation of additional filing rules.

- RaptorXML+XBRL Server: For high-performance, server-based validation of EBA XBRL reports, RaptorXML has an option to specify whether the additional supervisory data quality checks should be performed.

Get started now

All Altova XBRL tools described here are available for a free, 30-day trial.